| April 2023 | April 2024 | ||

| Interest Rate | 6.41 | 6.91 | |

| Inventory | 5148 | 9476 | |

| Months of Inventory | 1.86 | 3.4 | |

| Sold Homes | 2766 | 2759 | |

| Days on Market to Contract | 52 | 54 | |

| Median Price (Homes, Condos, Townhomes) | $370000 | $386500 | 7.1% inc |

| Average Price (Homes, Condos, Townhomes) | $443718 | $475122 | 5.0% inc |

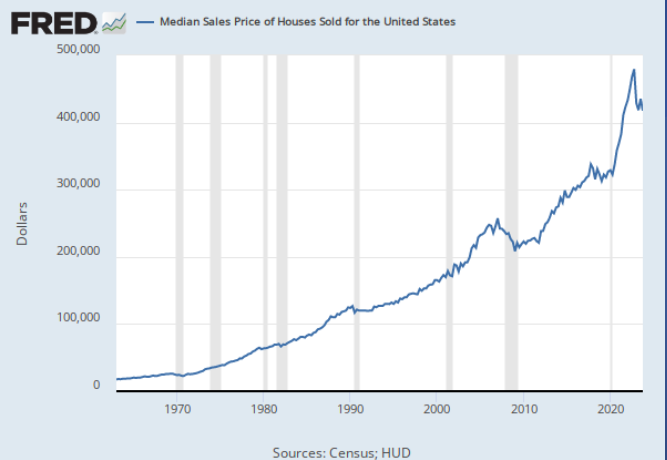

The Market is showing that since October 2023 the market is increasing. Year over year for the last 3 months has been close to a 5% increase when looking at a year over year median price. Prior to October of 2023 we were looking at stagnant prices for the last couple of years. The increase is not huge, but it is normal appreication. Since 1992 overall in the US the increase due to appreciation is 4.62% year over year. In my opinion, the market stabalized when the interest rates increased. The blessing for homeowners in Central Florida is that the prices did not decrease.... they stayed the same when this happened. We had to wait some time for buyers to get used to the "new normal" of Interest rates.

In looking at Interest Rates over the last 60 years... Here is a Graphic of the history of the rates.

So As you see the interest rates today are fairly normal... however, the housing prices are much higher than they were in previous decades. In looking at the Median Prices of Homes in the US in the same time period shows this. This is the entire US and here in Central Florida we did not take the dip down as shown on the graph.

So the question is... should you buy now or wait. Since 1980, the average annual rent increase has been 8.86%. As I mentioned earlier, homes appreciated by 4.62% per year since 1992. They also found that US Homeowners have a net worth 40X greater than renters. Give us a call/text at 407-566-2555 or email laura@yourhomesoldgr.com and let's build your wealth!

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !